All Categories

Featured

Table of Contents

- – What is Term Life Insurance With Accidental De...

- – Is Joint Term Life Insurance the Right Choice ...

- – Why You Need to Understand Guaranteed Level T...

- – What is Term Life Insurance With Level Premiu...

- – What is What Does Level Term Life Insurance ...

- – What is Life Insurance? Pros, Cons, and Cons...

If George is diagnosed with a terminal illness throughout the very first policy term, he most likely will not be qualified to restore the policy when it runs out. Some plans use ensured re-insurability (without proof of insurability), yet such features come with a greater cost. There are numerous kinds of term life insurance policy.

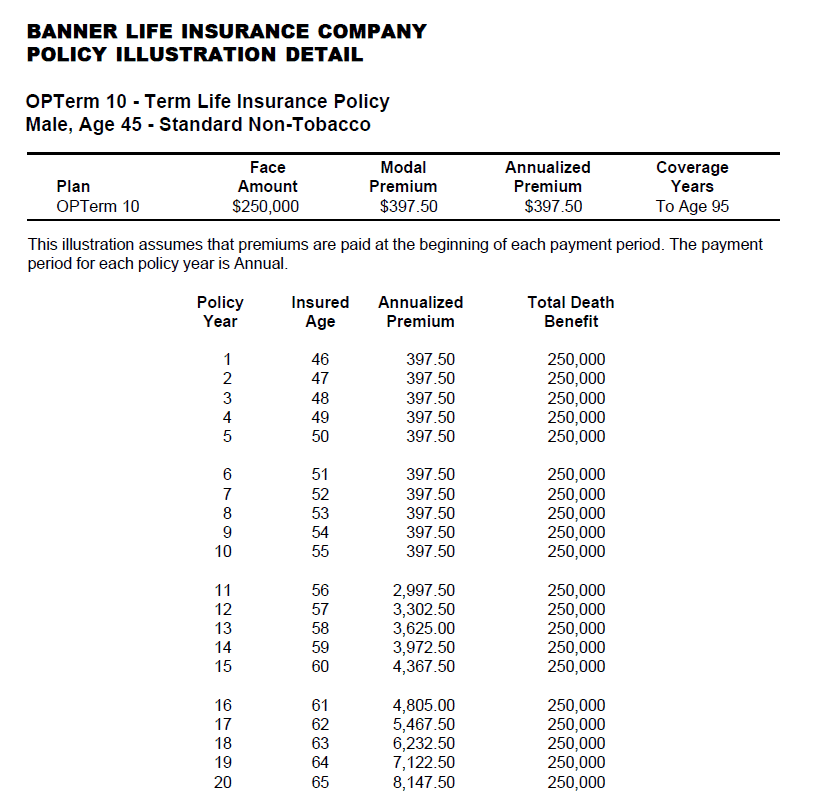

Generally, most business use terms ranging from 10 to 30 years, although a couple of offer 35- and 40-year terms. Level-premium insurance policy has a fixed regular monthly settlement for the life of the plan. Most term life insurance policy has a level costs, and it's the kind we have actually been referring to in a lot of this short article.

Term life insurance policy is eye-catching to young individuals with children. Moms and dads can obtain significant protection for an inexpensive, and if the insured passes away while the plan holds, the family members can depend on the survivor benefit to replace lost revenue. These policies are likewise well-suited for individuals with growing family members.

What is Term Life Insurance With Accidental Death Benefit and Why Does It Matter?

Term life plans are perfect for individuals that desire significant insurance coverage at a low price. People that own entire life insurance policy pay more in costs for much less coverage but have the safety and security of recognizing they are protected for life.

The conversion motorcyclist should allow you to transform to any long-term plan the insurance policy business provides without constraints. The primary features of the motorcyclist are preserving the initial health score of the term plan upon conversion (even if you later have health problems or end up being uninsurable) and deciding when and how much of the coverage to transform.

Of program, total premiums will certainly boost considerably since whole life insurance policy is extra costly than term life insurance coverage. Clinical conditions that develop during the term life period can not trigger premiums to be increased.

Is Joint Term Life Insurance the Right Choice for You?

Entire life insurance policy comes with substantially greater month-to-month costs. It is indicated to offer coverage for as long as you live.

It depends upon their age. Insurance companies established a maximum age limitation for term life insurance policies. This is generally 80 to 90 years old yet may be greater or reduced depending on the firm. The premium likewise climbs with age, so an individual aged 60 or 70 will pay significantly greater than a person years younger.

Term life is somewhat comparable to auto insurance coverage. It's statistically not likely that you'll need it, and the premiums are money down the tubes if you do not. But if the most awful occurs, your family members will obtain the benefits (Level term life insurance).

Why You Need to Understand Guaranteed Level Term Life Insurance

For the most component, there are 2 kinds of life insurance policy strategies - either term or long-term strategies or some mix of the two. Life insurance companies supply different kinds of term strategies and traditional life policies as well as "passion delicate" items which have actually come to be a lot more prevalent because the 1980's.

Term insurance supplies defense for a specified period of time. This duration can be as short as one year or give insurance coverage for a particular variety of years such as 5, 10, twenty years or to a defined age such as 80 or sometimes as much as the oldest age in the life insurance policy mortality.

What is Term Life Insurance With Level Premiums? Key Points to Consider?

Currently term insurance prices are really affordable and amongst the lowest traditionally experienced. It should be kept in mind that it is a commonly held belief that term insurance policy is the least costly pure life insurance policy coverage available. One needs to assess the policy terms carefully to make a decision which term life options appropriate to fulfill your particular conditions.

With each new term the costs is boosted. The right to restore the policy without proof of insurability is a vital advantage to you. Or else, the risk you take is that your wellness might weaken and you may be incapable to obtain a plan at the exact same prices and even whatsoever, leaving you and your beneficiaries without insurance coverage.

The size of the conversion duration will certainly differ depending on the type of term policy bought. The costs price you pay on conversion is generally based on your "current achieved age", which is your age on the conversion day.

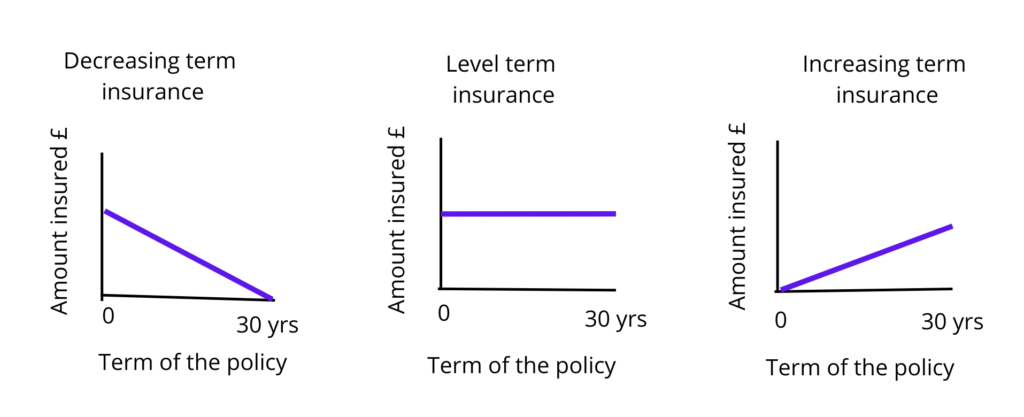

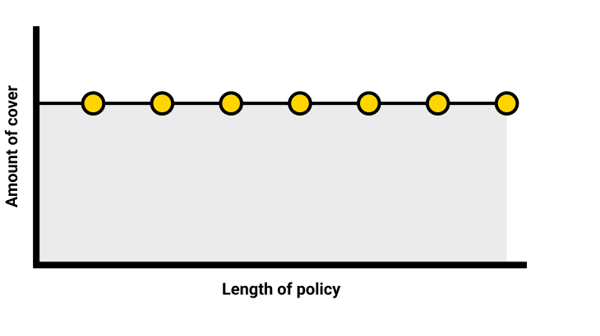

Under a degree term plan the face amount of the policy continues to be the exact same for the whole duration. With decreasing term the face quantity reduces over the duration. The premium remains the very same each year. Usually such plans are sold as mortgage defense with the quantity of insurance policy lowering as the equilibrium of the home mortgage decreases.

Traditionally, insurance firms have not deserved to alter costs after the plan is offered. Since such policies might proceed for lots of years, insurers have to make use of traditional death, passion and cost rate price quotes in the premium calculation. Flexible costs insurance coverage, nonetheless, allows insurers to supply insurance at reduced "current" costs based upon less traditional presumptions with the right to transform these premiums in the future.

What is What Does Level Term Life Insurance Mean? How It Helps You Plan?

While term insurance coverage is developed to provide security for a specified period, irreversible insurance policy is made to offer protection for your entire life time. To keep the costs rate level, the costs at the younger ages exceeds the actual expense of protection. This added costs builds a reserve (cash money worth) which helps pay for the policy in later years as the cost of security surges over the costs.

The insurance company spends the excess costs bucks This type of plan, which is often called cash money value life insurance, generates a cost savings component. Cash values are vital to a long-term life insurance plan.

Often, there is no relationship in between the dimension of the cash money worth and the premiums paid. It is the cash money value of the plan that can be accessed while the policyholder is alive. The Commissioners 1980 Requirement Ordinary Mortality (CSO) is the existing table utilized in computing minimum nonforfeiture values and plan gets for regular life insurance policy policies.

What is Life Insurance? Pros, Cons, and Considerations?

Many irreversible policies will certainly consist of stipulations, which define these tax needs. Traditional entire life policies are based upon long-term price quotes of expenditure, rate of interest and death.

Table of Contents

- – What is Term Life Insurance With Accidental De...

- – Is Joint Term Life Insurance the Right Choice ...

- – Why You Need to Understand Guaranteed Level T...

- – What is Term Life Insurance With Level Premiu...

- – What is What Does Level Term Life Insurance ...

- – What is Life Insurance? Pros, Cons, and Cons...

Latest Posts

Life Insurance Policy To Pay For Funeral

Final Expense Insurance Quote

Final Expense Life Insurance Policy

More

Latest Posts

Life Insurance Policy To Pay For Funeral

Final Expense Insurance Quote

Final Expense Life Insurance Policy