All Categories

Featured

Table of Contents

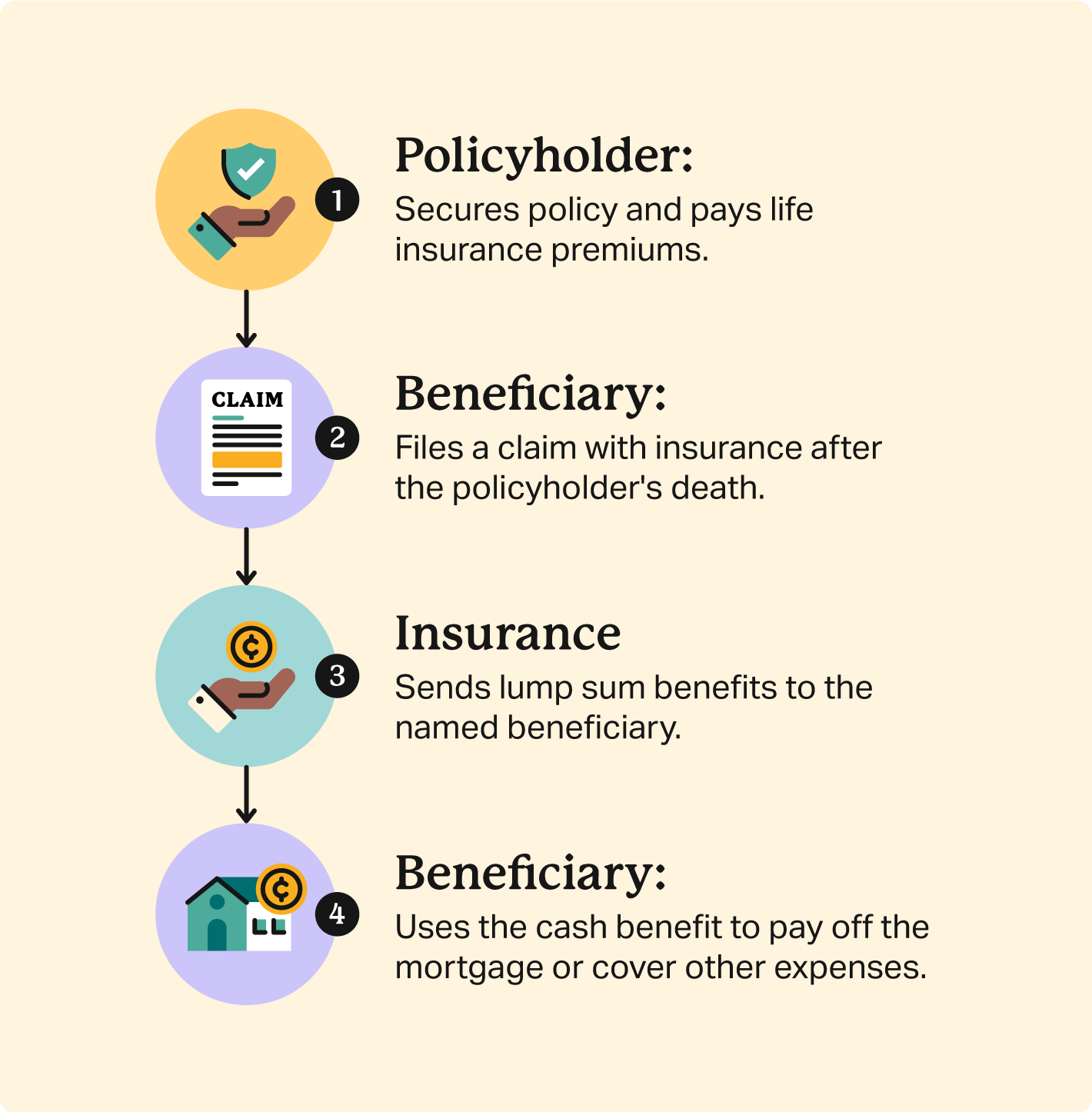

Life insurance agents sell home loan defense and loan providers sell home loan defense insurance coverage, at some point. home loan insurance policy. Below are the two kinds of representatives that offer home mortgage defense (what does pmi insurance cover).

Getting home mortgage security with your lender is not always a simple job, and often times fairly confusing. Lenders normally do not sell home mortgage protection that benefits you.

Protection Insurance Companies

The letters you receive appear to be coming from your lender, but they are simply coming from 3rd party companies. mortgage protection insurance age limit. If you do not wind up getting typical home loan defense insurance, there are other types of insurance you might been called for to have or could wish to consider to safeguard your investment: If you have a mortgage, it will certainly be required

Particularly, you will desire house protection, components protection and personal responsibility. credit life insurance home mortgage. In addition, you must think about including optional coverage such as flooding insurance policy, quake insurance, replacement price plus, water backup of drain, and various other frameworks insurance policy for this such as a gazebo, shed or unattached garage. Just as it appears, fire insurance coverage is a form of residential property insurance policy that covers damages and losses caused by fire

This is the main option to MPI insurance policy. Entire life is a permanent plan that is extra costly than term insurance policy however lasts throughout your whole life.

Protection is normally limited to $25,000 or less, yet it does shield against having to touch various other monetary resources when an individual passes away (private mortgage insurance death). Last cost life insurance policy can be used to cover medical expenses and various other end-of-life expenditures, including funeral and funeral costs. It is a kind of long-term life insurance that does not run out, but it is a much more costly that term life insurance

Life Insurance For House Mortgage

Some funeral chapels will approve the project of a final expenditure life insurance policy policy and some will not. Some funeral chapels call for repayment up front and will certainly not wait until the last expenditure life insurance policy plan pays. It is best to take this right into factor to consider when dealing when considering a last cost in.

You have a number of alternatives when it comes to purchasing home loan security insurance coverage. Amongst these, from our perspective and experience, we have located the complying with companies to be "the best of the finest" when it comes to issuing home mortgage protection insurance policy plans, and suggest any type of one of them if they are alternatives presented to you by your insurance policy agent or home loan lending institution.

Loss Of Job Insurance For Mortgage

Can you obtain home mortgage security insurance for homes over $500,000? The greatest distinction between home mortgage defense insurance for homes over $500,000 and homes under $500,000 is the need of a medical exam.

Every firm is various, but that is a great general rule. Keeping that stated, there are a couple of business that use home mortgage protection insurance as much as $1 million without medical tests. does mortgage insurance cover unemployment. If you're home is worth less than $500,000, it's extremely likely you'll get plan that does not require medical examinations

Home mortgage security for low income real estate generally isn't needed as the majority of low income real estate units are rented and not possessed by the resident. The owner of the devices can definitely buy home loan protection for reduced earnings housing unit renters if the plan is structured appropriately. In order to do so, the residential or commercial property proprietor would certainly require to deal with an independent representative than can structure a group strategy which enables them to combine the residents on one policy.

If you have questions, we extremely suggest consulting with Drew Gurley from Redbird Advisors. Drew Gurley belongs to the Forbes Money Council and has actually functioned a few of the most one-of-a-kind and varied mortgage defense strategies - life insurance for mortgage cover. He can definitely assist you analyze what is required to put this sort of strategy together

Takes the uncertainty out of safeguarding your home if you die or end up being impaired. Cash goes directly to the home loan company when a benefit is paid out.

Latest Posts

Life Insurance Policy To Pay For Funeral

Final Expense Insurance Quote

Final Expense Life Insurance Policy